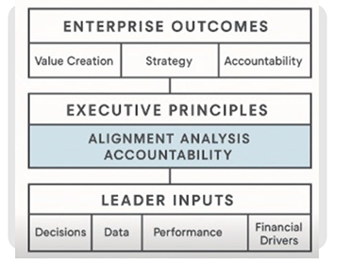

Most leaders rise in their careers because they excel in their first language – engineering, operations, product, marketing, HR. They know how to deliver results, develop people, solve complex problems, and manage day-to-day performance. But as their responsibilities expand, a subtle shift occurs: the conversations around them begin happening in a second language – the language of value, performance, and cash.

Some leaders adapt naturally. Others start to feel a gap – not in capability, but in translation. They can describe the work, but not always the financial impact of the work. They can explain their priorities, but not always the economic logic behind those priorities. This isn’t because they are weak leaders. It is because they were never taught the logic senior leaders use to evaluate decisions.

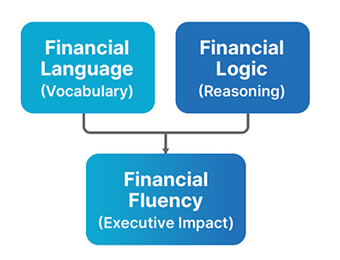

This is where financial fluency – the core outcome of the Finance as a Second Language® (FSL®) Program – becomes a competitive advantage.